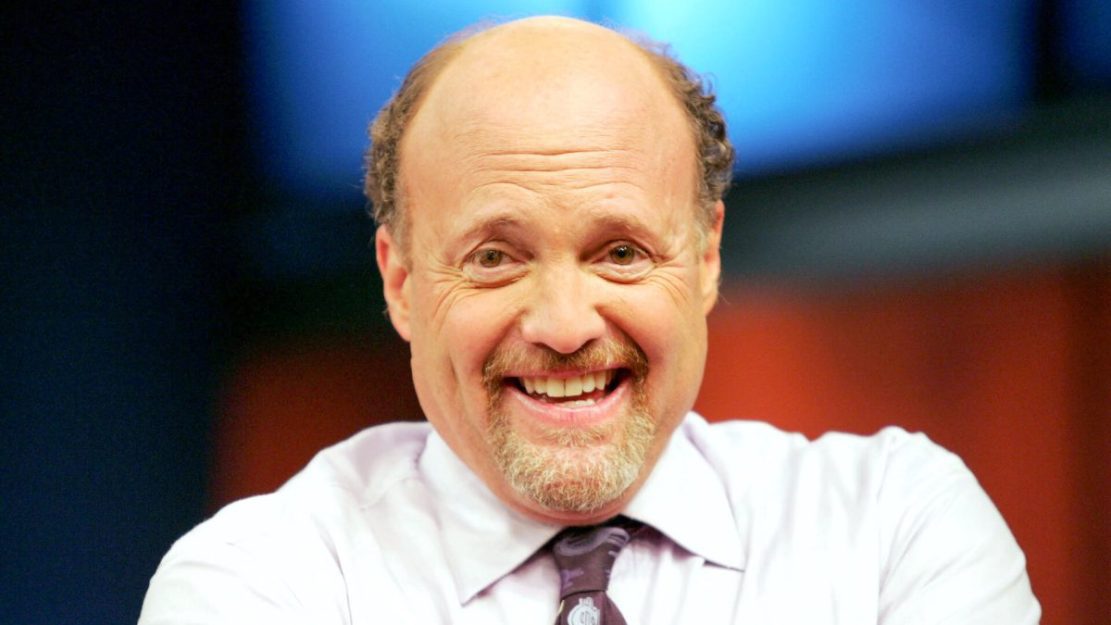

Who is Jim Cramer?

Jim Kramer, son of Ken and Louis Kremer, was born on February 10, 1955, in Winador, the outskirts of Philadelphia, Pennsylvania. His mother is an artist, and his father owns an international packaging company.

Harvard Crimson University was always president and president of Harvard University in 1984 for Jim. After returning to school for the second time, he graduated from Harvard Business College. Jim Care Moore will invest in stocks when he becomes a teaching staff at Harvard University to pay for his education.

Net worth

According to Money, Inc Jim Cramer, the net value is about $ 150 million as of 2022.

Many clear values come from their success as the director of the Risk Protection Fund. But his success did not end there. Using his experience as director of care to increase the value of his network through different strategies.

Also read about Biography of Anton James Pacino

The market value and the property’s cash flow increased the net value, bad behavior, and the success of “MAD Money” as a host. Arrows are a pioneer in advice marketing.

Career

After leaving Goldman Sachs, the first Jim in the financial industry from 1987 to 2001, Kremir and Co. were founded.

Carromers will have a 24 % return at the internet top in 1999 and will be very successful for him. After the general offering, the company will increase to $ 1.7 billion.

Jim Craamer investors are currently at $ 225 million. As a result, Carom loses a large part of his reserves when he has a point. The clear value of Jim Kramer is still $ 150 million.

In addition, Craamer works as an editor of SmartMoney Mag, which received $ 2 million in stock recommendations from its members.

At the end of 1990, Jim Kramer was launched in CNBC programming, and at the beginning of 2000, all priests began in 2002 with “Kudlow & Craamer”. I launched the current program. Jim Kramer’s salary for Mad Money, who runs CNBC, has $ 5 million a year.

success

In 1987, Jim Kermer received information about the stock market and the foundations of his risk prevention company. Craamer & Co.

Care Marm increased from her background from 1987 to 2000 and has only one negative return. Finally, he retired from the Fund Fund in 2001 by providing an annual average annually from 1987 to 2001 and offered an average of $ 10 million annually for 14 years.

CNBC’s “MAD Money,” known to be hosted by Jim Cramer, teaches people to think as professional investors instead of telling people what they will think about.

In 1996, Kremer became a risk prevention box. Websites that offer ideas and suggestions on the Stock.com stock market

Carrome is the second largest shareholder in the company, and at some point, the company’s market value is $ 1.7 billion.

However, in August 2019, Mavin Thestarrett took.

In 2005, the most famous Jim Cramer signed “MAD Money” at CNBC.

The purpose of the performance is to teach the public as a professional investor and not tell others what they think about it. Performance has increased in the past ten years, making it one of CNBC’s most popular investment programs.

Karem’s success hosted him in the “MAD Money” story, and he appeared as a guest in many investment programs in many broadcasting companies. In addition, vehicles are guests of unusual programs unrelated to investment, such as “Development” tonight and “The Daily Show.”

Special thinking

“I lost a lot of money in many markets, and I think this is what makes you better in my job,” Carmers once said.

Words are a good example of species. Transport companies have become an experience as a manager to protect against risk and air investment consultant. Investors will have to pay for a long time in the game. However, what investors do with learning makes them successful or unsuccessful.

“I will always come back with what I believe in and I believe in,” said Kiir Mir. “Everyone has the right to be rich in this country and I want to help them go there.”

This collected Carmeer’s ideas when he advised his performance. “Madness”

However, Caremer did not have critics and arguments in 1995. He was accused of managing the stock price after writing about his many small companies in the stocks, which eventually led to two million dollars. This leads to the accusation that transportation operations are conflicts of interest when promoting the shares they possess. For a personality or money

Other critics say that the date of selection of stocks in Carom TV and other public shops is not a hero. Researchers have analyzed Carmer’s details since the beginning of the

portfolio and since the beginning of money in 2005 (when the wallet was converted into helpful confidence). They found that transport companies are the S&P 500 compensation index, general returns, and less. On risk, returns depend on the acute rate.