How to Calculate PVIFA Using a Calculator

In order to calculate the present value interest factor of the annuity PVIFA calculator, you’ll need to use a financial calculator. Thankfully, most scientific and graphing calculators have the ability to perform this calculation. In this blog post, we’ll walk you through the steps on how to calculate PVIFA using a calculator.

Body: 1) Clear any previous entries from your calculator. 2) Enter the interest rate per period. For example, if the interest rate is 5% per year and you’re calculating for quarterly periods, then you would enter 1.25% (5%/4). 3) Enter the number of periods. For example, if you’re calculating for 10 years, then you would enter 40 (10*4). 4) Hit the 2nd key and then the “EV” key.

The “EV” key stands for “present value interest factor of the annuity. 5) Enter the number 1 on your calculator. 6) Hit the equals key (=). The number on your screen is the present value interest factor of annuity. 7) To calculate the add-on amount, multiply this number by the periodic payments.

Conclusion: The present value interest factor of annuity allows you to find the amount that needs to be added to each periodic payment in order for there to be no change in value at the end of a specific time period. This number is important for buyers and sellers of annuities as it allows them to compare different options. Luckily, it’s easy to calculate using a financial calculator! just now

How to calculate PVIFA on a calculator

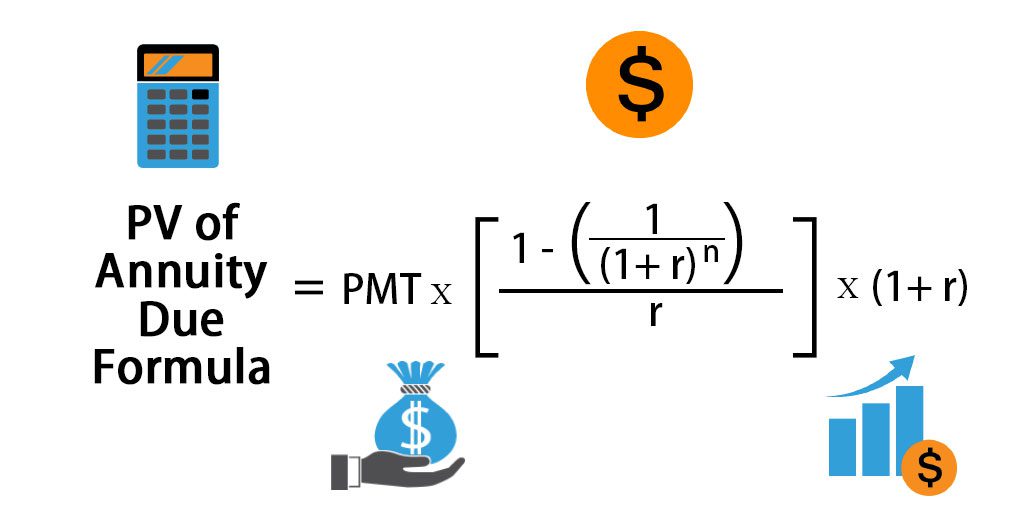

PVIFA, or the present value interest factor of annuity, is a mathematical formula used to determine the value of an annuity stream. An annuity is defined as “a series of payments made at equal intervals. The PVIFA formula is essential for anyone looking to invest in an annuity, as it allows you to calculate the present value of the stream of payments you will receive. There are a few different ways that you can calculate the PVIFA, but for this example, we will be using a calculator. In order to calculate the PVIFA, you will need to know the interest rate, number of periods, and present value. If you do not have a calculator handy, don’t worry! There are plenty of online PVIFA calculators that you can use for free. Just Google “PVIFA calculator” and you’ll find some great options.

Once you have gathered all of the necessary information, follow these steps to calculate

the PVIFA: 1) Enter the interest rate into your calculator. This should be entered as a decimal (for example, 6% would be entered as .06). 2) Press the “divide” button on your calculator. 3) Enter the number of periods into your calculator.

This is the number of payments that will be made over the course of the annuity. 4) Press the “equals” button on your calculator. 5) Enter the present value into your calculator. This is the lump sum amount that you will receive at the end of the annuity stream. 6) Press the “equals” button on your calculator again. The answer that appears on your screen is the PVIFA! And there you have it—calculating the PVIFA is much simpler than it may seem at first glance.

By following these simple steps, you can easily determine the present value of an annuity stream. Conclusion: The PVIFA formula is a quick and easy way to determine the present value of an annuity stream. By following these simple steps, you can calculate the PVIFA in no time!

Let us show you one of the most useful terms or methods to get assistance in this process. PVIFA can help you in checking whether you should take your investment back as a single payment or get it in annuities. If you want to calculate your relative fat mass then you can use rfm calculator.

If you want to get more information related to education then you can visit here thepostingzone.com